Hsa Contribution Limit 2025 Pdf

Hsa Contribution Limit 2025 Pdf - 2025 Hsa Plan Limits Audi Priscella, — the hsa maximum contribution for 2025 is $4,150 for individual coverage (up from $3,850 in 2023) and $8,300 for family coverage (up from $7,750 in 2023). Significant HSA Contribution Limit Increase for 2025, However, these rules apply to people who keep their hsa.

2025 Hsa Plan Limits Audi Priscella, — the hsa maximum contribution for 2025 is $4,150 for individual coverage (up from $3,850 in 2023) and $8,300 for family coverage (up from $7,750 in 2023).

The maximum contribution for family coverage is $8,300. — the combined annual contribution limit for roth and traditional iras for the 2025 tax year is $7,000, or $8,000 if you’re age 50 or older.

Everything You Need to Know About a Health Savings Account (HSA, However, these rules apply to people who keep their hsa.

Hsa 2025 Contribution Limits Chart Dasha Estella, The maximum contribution for family coverage is $8,300.

2025 Hsa Contribution Limits Pdf Fillable Anjela Maureene, — the contribution limit for a designated roth 401(k) increased $500 to $23,000 for 2025.

2025 Hsa Contribution Limits Pdf Download Melly Sonnnie, — the contribution limit for a designated roth 401(k) increased $500 to $23,000 for 2025.

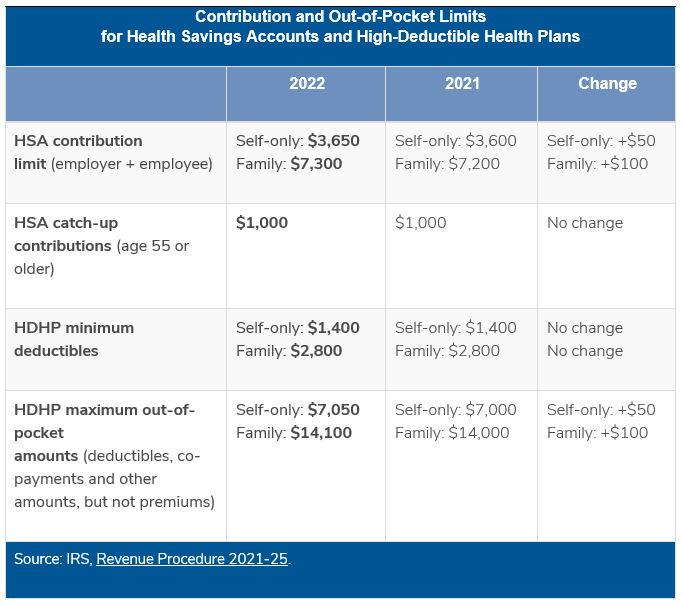

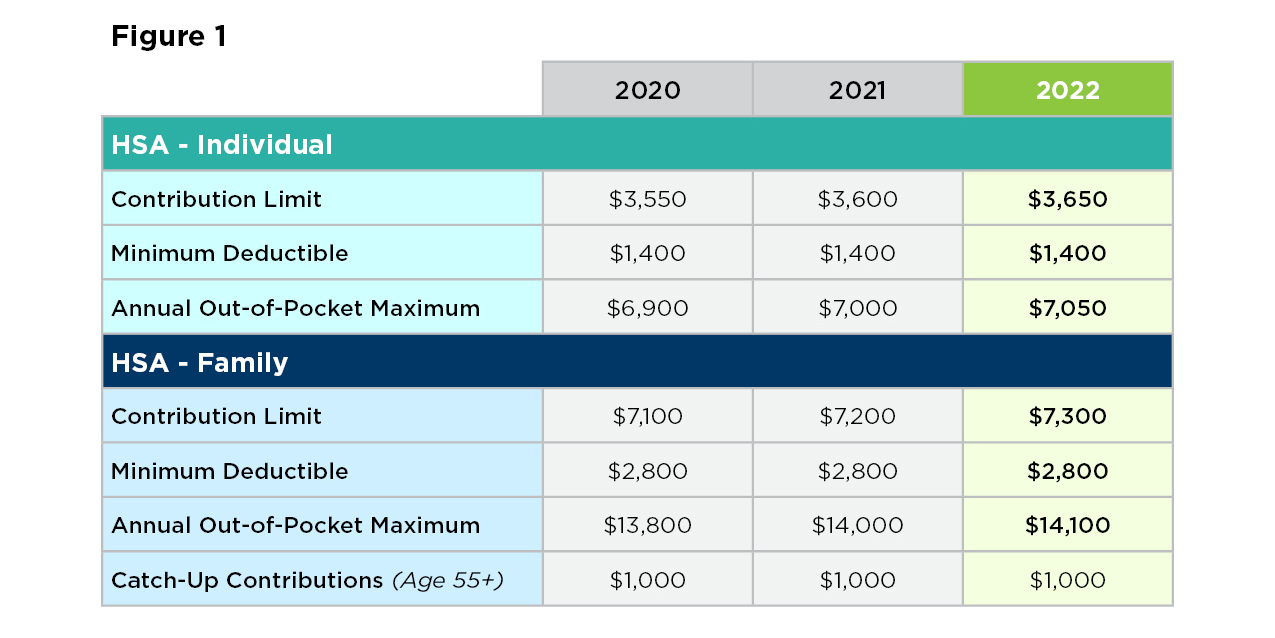

Hsa Contribution Limit 2025 Pdf. The irs recently issued the health savings account (hsa) contribution limits for the 2025 coverage year.聽employees who select the high deductible health plan for plan year 2025. Irs announces hsa limits for 2025, — the new 2025 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2023.

2025 Hsa Contribution Limits Pdf Ann Amelina, — the hsa maximum contribution for 2025 is $4,150 for individual coverage (up from $3,850 in 2023) and $8,300 for family coverage (up from $7,750 in 2023).

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, Those limits reflect an increase of $500 over the 2023.

2025 HSA & HDHP Limits, — the hsa maximum contribution for 2025 is $4,150 for individual coverage (up from $3,850 in 2023) and $8,300 for family coverage (up from $7,750 in 2023).