2025 Section 179 Limits Vehicles 2025 Images References :

2025 Section 179 Limits Vehicles 2025 Images References : - Section 179 Deduction Vehicle List 2025 Excel nedi vivienne, The section 179 deduction allows businesses to deduct the cost of qualifying vehicles over 6,000 lbs from taxable income, providing substantial tax relief and immediate. 2025 Section 179 Limits Ardys Winnah, Certain vehicles are not subject to the section 280f depreciation limits:

Section 179 Deduction Vehicle List 2025 Excel nedi vivienne, The section 179 deduction allows businesses to deduct the cost of qualifying vehicles over 6,000 lbs from taxable income, providing substantial tax relief and immediate.

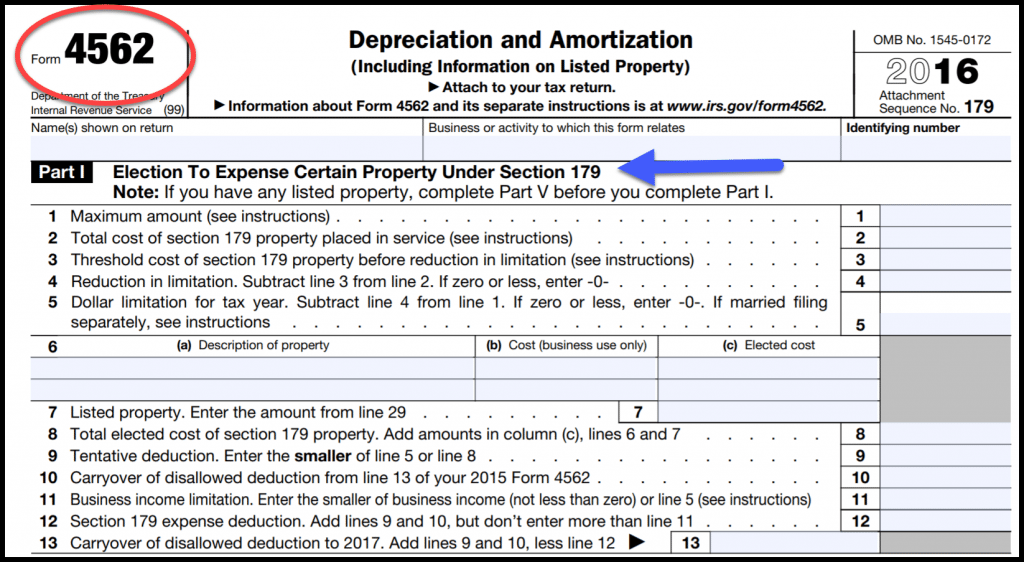

Section 179 Limit 2025 Lenka Nicolea, The irs has set specific limits for section 179 in 2025:

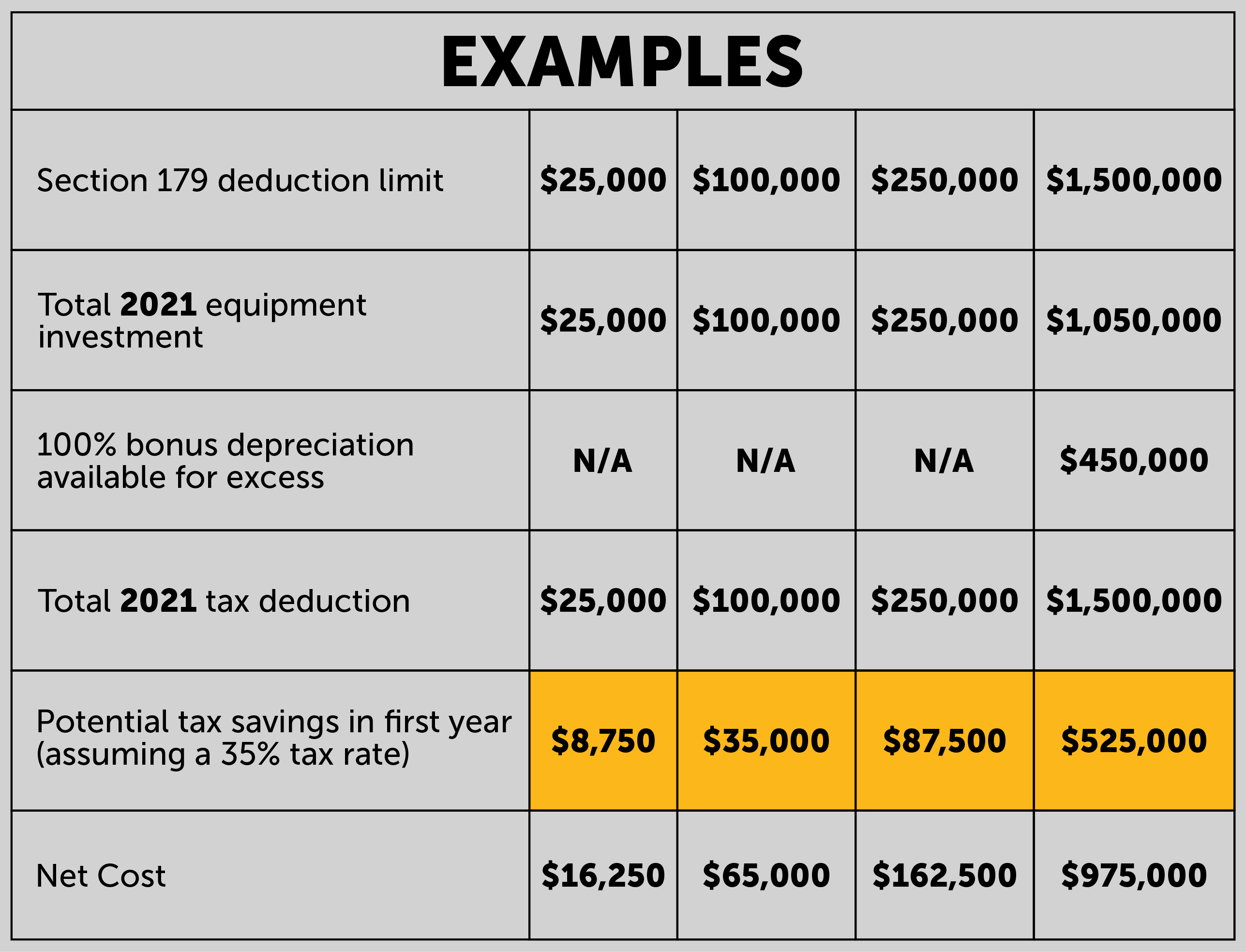

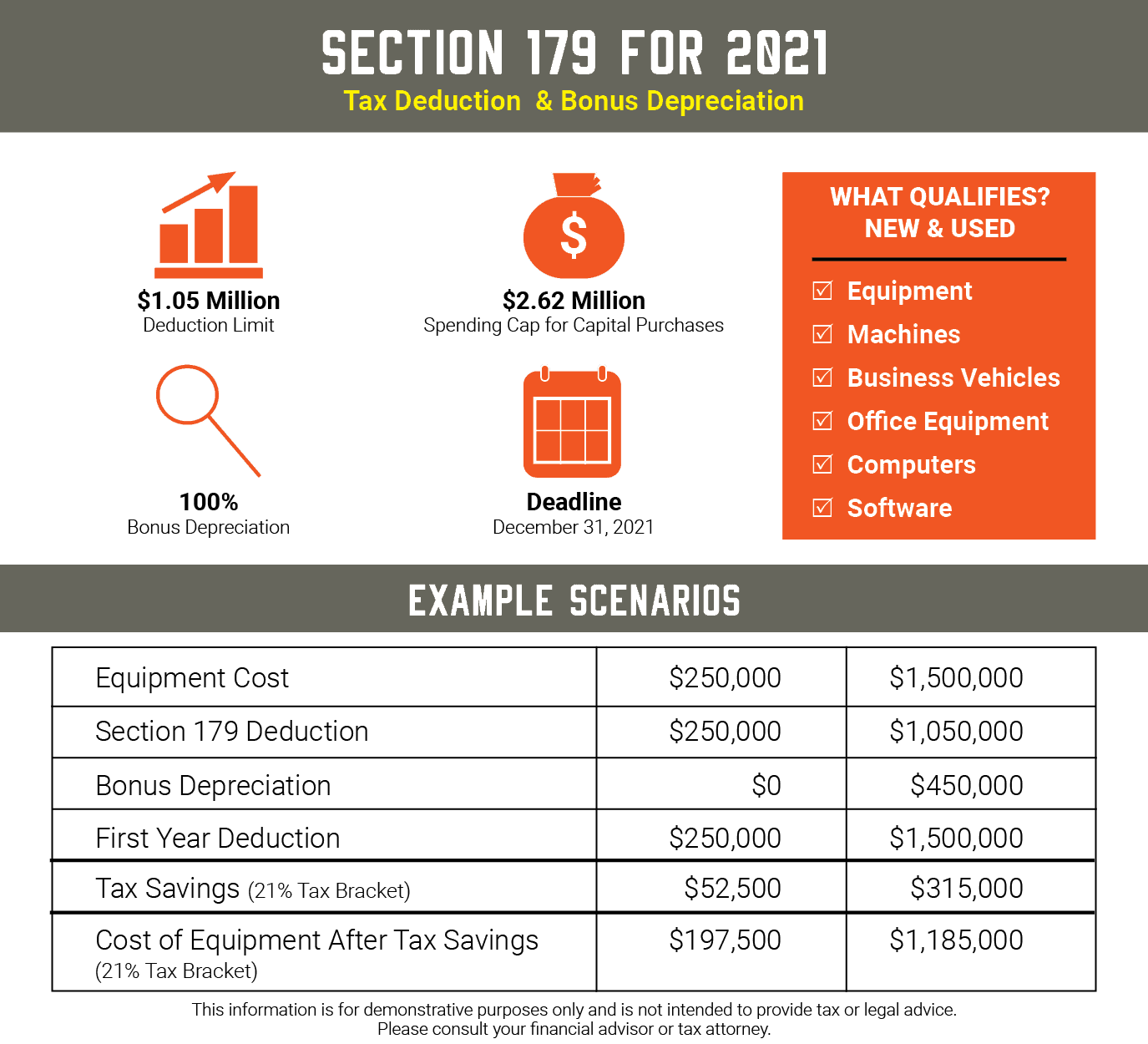

2025 Section 179 Limits Vehicles Elset Felicle, Claiming section 179 depreciation expense on the company’s federal tax return reduces the true cost of the purchase to $130,000 (assuming a 35% tax bracket), freeing up $70,000 in cash.

2025 Section 179 Limits For Light Vehicles Gussie Karrie, In 2025, the maximum deduction allowed for vehicles is $1,050,000.

2025 Section 179 Limits For Light Vehicles Gussie Karrie, Maximum deduction limits for vehicles.

2025 Section 179 Limits Vehicles 2025. For 2025, the irs has set the deduction. Maximum deduction limits for vehicles.

2025 Section 179 Limits Vehicles Limit Dodie Stacia, Generally, there is no maximum limitation like there is in the section 179 calculation.

179 deduction is $1.22 million (up from $1.16 million for 2023). Learn about the 2025 irs depreciation limits for business vehicles, including luxury cars, suvs, trucks, and vans.

2025 Section 179 Limits Vehicles Elset Felicle, The irs sets specific limits on the total cost of vehicles that qualify for section 179 deductions.

Section 179 IRS Tax Deduction Updated For 2023, 50 OFF, • heavy suvs*, pickups, and vans (over 6,000 lbs.

Section 179 Vehicles 2025 Limit Agna Merrill, Will section 179 go away in 2025?

:max_bytes(150000):strip_icc()/Term-Definitions_Section-179-resized-1a04b9f84c4d4141b11d1d9ca10fb981.jpg)